OpenAI revises strategy for ChatGPT’s instant checkout feature

Meta updates click attribution: only link clicks will count

Google launches Nano Banana 2 model

4 minutes

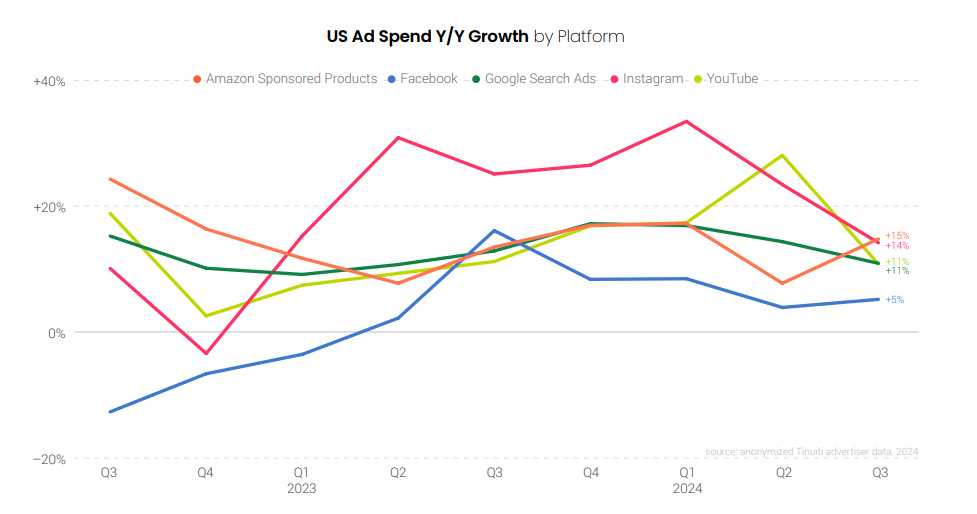

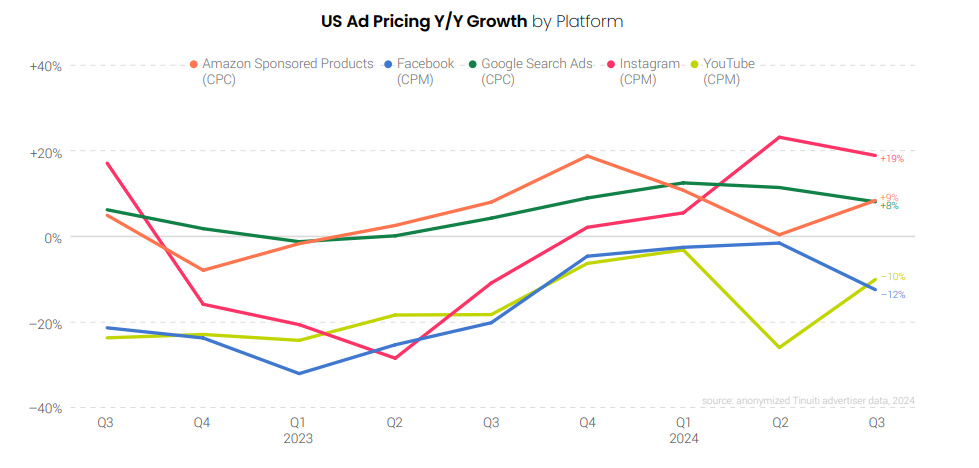

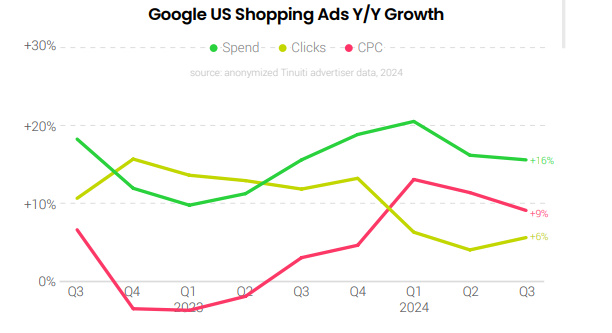

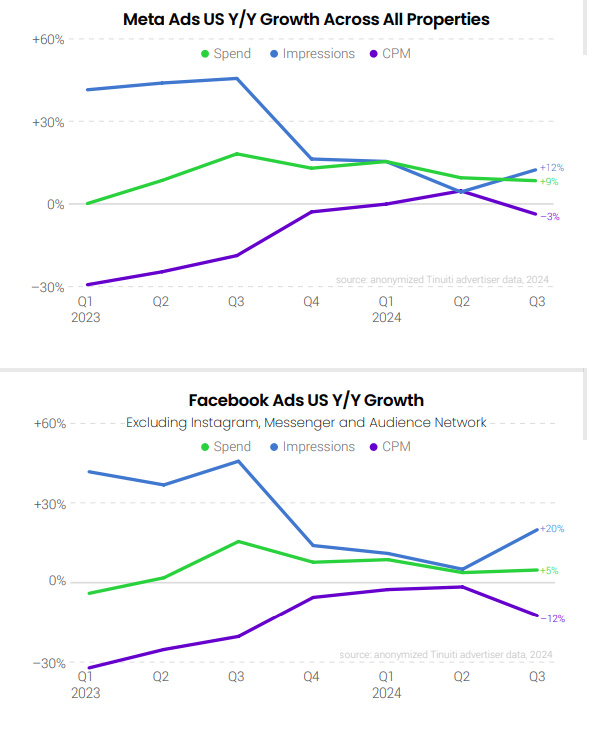

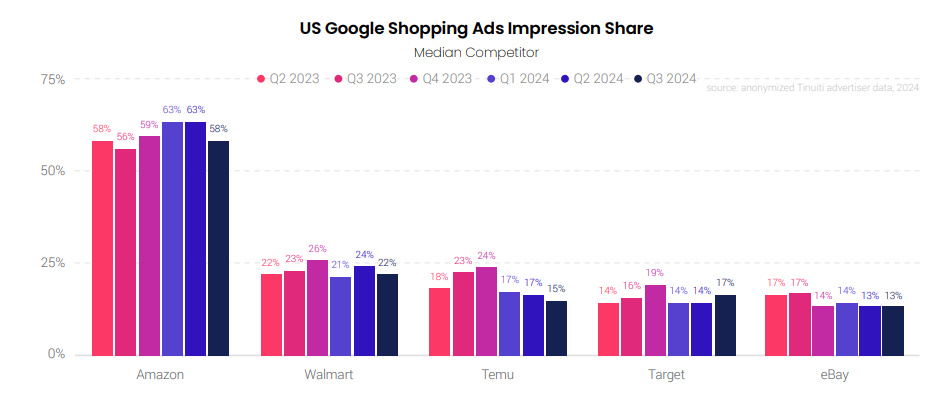

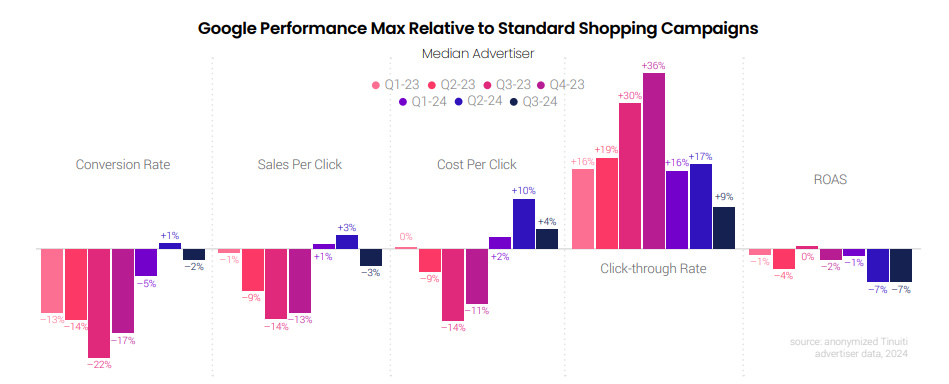

Search ads, shopping ads, and PMax adoption remain stable, with cost-per-click (CPC) metrics showing growth, according to a new report from Tinuiti.

Google search ad spending increased by 11% year over year in Q3 2024, reflecting resilience despite slower price growth and the introduction of AI-driven features, as noted in Tinuiti’s latest “Digital Ads Benchmark Report.”

Campaign Performance Metrics

Impact of Google AI Overviews

Why This Matters

The data indicates that despite the initial impact of Google AI Overviews on advertising performance, advertisers are adapting and discovering ways to maintain growth, particularly through shopping ads and Performance Max campaigns.

Key Takeaways

At UAMASTER, our specialists are prepared to optimize your advertising strategies to leverage these trends effectively. We will help you adapt strategies based on innovative technologies, particularly on the Performance Max platform, to achieve better results in Google Shopping. Our tailored advertising solutions will increase your company’s profits by focusing on your target audience. Contact us to discuss opportunities and strategies to meet your business goals.

Tinuiti’s Q3 2024 Digital Ads Benchmark Report.

This article available in Ukrainian.

Say hello to us!

A leading global agency in Clutch's top-15, we've been mastering the digital space since 2004. With 9000+ projects delivered in 65 countries, our expertise is unparalleled.

Let's conquer challenges together!

performance_marketing_engineers/

performance_marketing_engineers/

performance_marketing_engineers/

performance_marketing_engineers/

performance_marketing_engineers/

performance_marketing_engineers/

performance_marketing_engineers/

performance_marketing_engineers/